- Home

- About Us

-

Products

Commodity Trading

Portfolio Management Services

- Career

- Contact Us

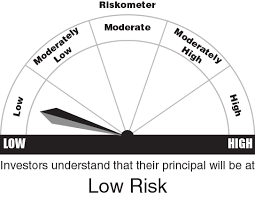

These returns are generated from low risk securities that pay predictable interest, and various methodologies can be employed to generate steady returns. Building a fixed income portfolio may include investing in bonds as well as bond mutual funds, certificates of deposit (CD), and money market funds.

These invest in Fixed Income Securities, like Government Securities or Bonds, Commercial Papers and Debentures, Bank Certificates of Deposits and Money Market instruments like Treasury Bills, Commercial Paper, etc. These are relatively safer investments and are suitable for Income Generation. Examples would be Liquid, Short Term, Floating Rate, Corporate Debt, Dynamic Bond, Gilt Funds, etc.